ecommerce, ecommerce website, ecommerce business, ecommerce sales, ecommerce growth, improve ecommerce, ecommerce in canada

The next normal for shopping involves more ecommerce.

The next normal for shopping involves more ecommerce.

As BC’s provincial health officer Dr. Bonnie Henry quipped on May 4, “we are at the end of the beginning.” In other words, the next normal is not our final destination but rather a chapter break. What does that mean for retail? Will the pandemic ecommerce growth seen be temporary or the next normal?

According to Think with Google, Canada’s ecommerce moment is now. The sales data shows that companies selling through physical and digital channels before the crisis were better positioned to respond. But it’s a struggle. And it’s unclear whether the online shopping trends will continue through fall, even as physical locations re-open.

Here’s what I recommend:

- Understand your ecommerce performance by looking at 3 key metrics over the last 90 days.

- Determine the patterns of behaviour by comparing performance of the 30-days before and after the peak-pandemic period starting March 16.

- Forecast online revenue and growth for fall by adjusting for COVID-related shopping patterns.

TL;DR Below are instructions on how to perform this analysis, with benchmark data based on analysis of a cross-section of Canadian independent publishers. Or you can hire me to do a one-off report for you with recommendations.

DIY Performance Analysis

The top 3 ecommerce performance indicators are:

- Revenue: How much do you sell?

- Traffic: How many visits does your ecommerce website get?

- Per session value: How much is each visit worth? Calculated as revenue divided by the number of sessions. I know, we could look at ecommerce conversion rate, which is orders divided by sessions, but right now businesses care about how much money they are making, not how many orders. Stay with me.

Use these metrics to compare performance for 30 days before and after March 16, which is when most Canadian businesses closed. Or for those with international customers, use March 11, as illustrated below.

The 3 distinct phases to compare are:

- Pre pandemic | February 8 to March 10: The 30 days before WHO declared the global pandemic on March 11, 2020.

- Peak pandemic | March 11 to Apr 10: The 30 days of peak panic, which included the closing of most Canadian businesses on March 16, the closing of the Canadian border on March 18, and widespread social-distancing measures.

- Post-traumatic growth | April 11 to May 11: The 30 days of the curve flattening and recovery planning. By the second week of April, many retailers had shifted to mail order or curbside pickup. Since we’re not yet post pandemic, I’m borrowing a psychology term “post-traumatic growth,” which defines a period of transformation following trauma that surpasses what was present before.

The sales patterns to consider when forecasting are:

- Weekly revenue and growth numbers for the top 3 ecommerce performance indictors. This will tell you if growth is continuing or flattening.

- Past performance benchmarks. In particular compare current performance to revenue and traffic from 2019 Black Friday/Cyber Monday (Nov 29 to Dec 2, 2019) to identify whether consumer demand is above or below previous peak sales periods. Likewise look back to the 30-day holiday period from Nov 29 to Dec 29.

Let’s go!

KPI #1 – Revenue

In Google Analytics, use the Acquisition > All Traffic report to measure total online sales from February 8 to May 11. The 90-day timeframe compared to the same timeframe last year will help you understand if sales are up or not.

Next, do some 30-day comparisons to understand how patterns changed over the pandemic.

Start by measuring your online sales from March 11 to April 10 and compare those numbers to the previous 30 day period (February 8 to March 10) . What percentage growth did you see? Did that growth continue?

Now measure sales from April 11 to May 11 and compare those numbers to the previous 30-day period (March 11 to April 10). What happened over time as consumers settled into the lockdown and adjusted their online shopping habits?

Later, you can look at May 12 to June 11 to understand if your ecommerce curve is flattening or continuing to grow as physical retail re-opens.

If your ecommerce revenue remains higher than normal, it is time to accelerate your operational capacity for online-order processing, customer service, and inventory management. The kink in the works will be supply chain disruptions—delayed shipments from printers, issues with paper shortages or a decline in printing capacity, cross-border customs backlogs—so now is the time to plan for your customer-service response.

Also re-jig your marketing promotions to align with online shoppers’ sensitivities to ease of ordering, free delivery, curbside options, and easy returns.

What else can you do?

Take a deeper dive into revenue by traffic source and double down on the profitable channels.

Now, before you forecast your ecommerce revenue and growth for fall, compare current performance to a typical seasonal spike like the Black Friday-Cyber Monday weekend (Nov 29 to Dec 2, 2019) or to the full holiday season (Nov 29 to Dec 29, 2019). Compare that past performance to the revenue and average order value of your ecommerce website’s current performance. Is consumer demand and purchase intent above or below that peak sales period? This can help you establish a benchmark for your fall season.

Speaking of performance benchmark’s, top-performing publisher ecommerce sites tracked by Boxcar Marketing are seeing on average 8 transactions a day and monthly revenue growth of 40% or more. Want to know how you compare?

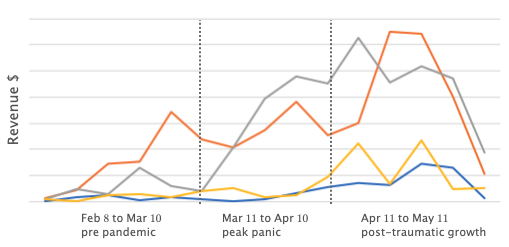

Here’s a snapshot of weekly ecommerce revenue from February 8 to May 11 for a cross section of independent publishers.

KPI #2: Traffic

Repeat the above process but look at Traffic, total sessions (or site visits), for the 90-day reporting period February 8 to May 11, 2020.

Total sessions are available in the same Google Analytics report: Acquisition > All Traffic.

Remember to do the 30-day comparisons to establish the changing traffic patterns. Was traffic stable or did your website see growth, or even a drop in traffic?

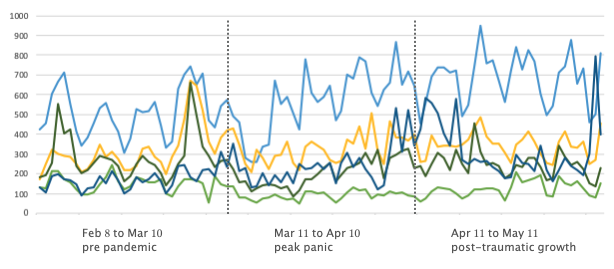

Below is a snapshot of daily sessions from February 8 to May 11 for a cross section of independent publishers.

The daily view shows the cyclical nature of publishers’ website traffic, with dips on the weekend and spikes mid-week.

Top-performing publisher ecommerce sites—avg. 500+ daily sessions pre-pandemic—are seeing monthly traffic growth of 20% whereas those averaging 100-499 daily sessions are seeing anywhere from 5-40% traffic growth depending on how rapidly they ramped up their digital marketing initiatives.

Again, for fall forecasting, it is worth looking at current traffic numbers compared to Black Friday/Cyber Monday or to another high traffic volume sales period.

Remember, not all traffic is equal. There are countless ways to drive traffic to your website through content marketing, referrals, and social media. The effort is worthwhile for generating demand, but you also need to attract traffic with high purchase intent.

If your fall marketing budget is limited, focus on SEO. Does your ecommerce website show up on the first page of results for variations of “buy “, “read …”, or “listen …” If not, now is the time to run search ads for your top-selling titles. And consider developing campaign-specific landing pages for those titles.

KPI #3: Per session value

Per session value is the total revenue for each day divided by sessions from each day.

Why use per session value vs. ecommerce conversion rate? If you’re not in a strong cash position then what you care about is revenue, not the number of orders.

Follow the same process above, but instead of using the Acquisition > All Traffic report, create a custom report in Google Analytics to show per session value.

Alternatively you can use the Acquisition > All Traffic report and select the metric on the line graph to be Per Session Value. Set the timeframe to the 90-day reporting period February 8 to May 11. Then export and create your data visualizations in a spreadsheet.

The animated gif shows how to set the timeframe and select different metrics.

Remember to do the 30-day comparisons to establish the changing patterns. Does traffic to your site have higher or lower purchase intent pre-pandemic? How does the current per session value compare to peak purchase intent during Black Friday/Cyber Monday? How is it changing over time?

The data analysis performed on a cross-section of publishing ecommerce sites shows that top-performers are seeing $1 or more per session value.

Methodology

A cross section of Google Analytics data from Canadian independent publisher ecommerce sites was used to compare revenue and sessions in the days before and after March 11, 2020. The data analysis looked at average performance of high performers, performers, and low performers to determine benchmarks.

Planning for Fall

Successful ecommerce stores need attention. Fall forecasting will be particularly difficult given the current uncertainties. The key is to differentiate what is temporary from what is the new normal. This is where actively monitoring your data analytics comes in.

You can expect top performers to:

- Continue or deepen their investment in digital.

- Increase their attention to real-time data.

- Adopt a nimble approach to deploying resources.

- Strengthen the integration between their marketing-technology-operations systems.

What’s the next normal for ecommerce in Canada

In 2019, ecommerce represented just 10% of Canada’s total retail sales vs 22% in the UK and 37% in China. We have been lagging but my bet is on ecommerce.

Improve your ecommerce: Boxcar Marketing offers advanced analytics reporting & strategy recommendations. We also provide customized training workshops to help teams upskill their analytics knowledge.

Related posts:

Other great reads: